The Resurgence of IPOs: Can Public Markets Unlock Private Investment Liquidity?

Private investors have faced a liquidity crunch in recent years as IPO and M&A windows largely shut in 2022 and 2023 amid market volatility and rising rates. Holding periods lengthened, fundraising slowed, and secondary markets grew as stopgaps. Against this backdrop, 2025 has begun to show signs of relief, with both IPO activity and secondaries providing much-needed release valves.

The Scale of the Liquidity Backlog

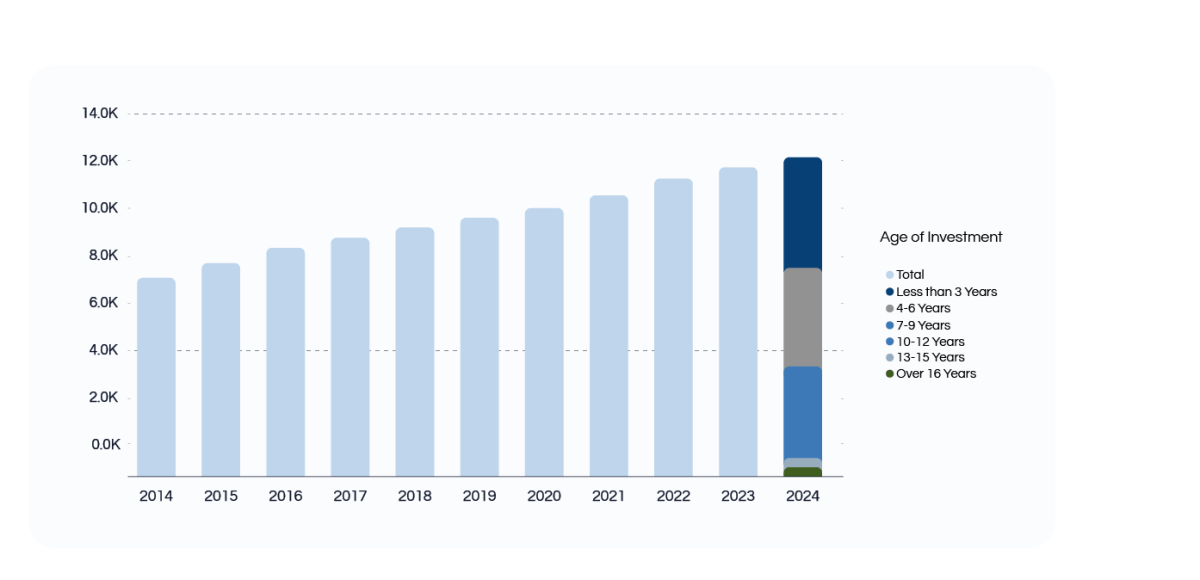

Private equity firms currently hold more than 12,000 portfolio companies in the United States alone, representing approximately eight years’ worth of inventory at current exit rates. This backlog has grown substantially from just over 7,000 companies in 2014, illustrating how new investments have consistently outpaced exits over the past decade. Average holding periods have extended to 6.7 years, compared to the long-term average of 5.7 years, with some funds experiencing hold times approaching 20-year highs. (1)(9)

Exit activity improved modestly in 2024, with 1,501 U.S. PE exits versus 1,287 the year before, but not enough to meaningfully reduce inventory. Fundraising has slowed in parallel, with timelines extending to a record 19 months on average as LPs hesitate to commit new capital while waiting for distributions. (3)(9)

Venture capital faces a similar buildup. Roughly 59,400 U.S. VC-backed companies are in the queue, and the median time since last funding has more than doubled to 2.4 years compared to 2021. In 2024, exit value reached $149.2B across 1,259 deals, an uptick, but still only a fraction of what’s needed to normalize liquidity. (10)(11)

How We Got Here

The post-pandemic boom of 2020–21 brought record-breaking IPO and M&A activity, capped by 397 U.S. IPOs in 2021 raising $142.4B. By 2022, the window slammed shut: only 71 IPOs launched in the U.S., raising $7.7B, as inflation and rising rates compressed valuations. (13)

That sudden reversal left late-stage unicorns and PE portfolio companies stuck in place. Distributions to LPs dried up, holding periods lengthened, and sponsors turned to workarounds: secondary sales of fund interests, GP-led continuation vehicles, down-round bridge financings, and even VC-to-VC acquisitions. These measures bought time but did little to reset the cycle. Capital recycling stayed impaired, fundraising slowed, and liquidity issues deepened. (11)

IPO Market Recovery

Against this backdrop of liquidity constraints, the IPO market has shown encouraging signs of recovery in 2025 that could provide much-needed exit opportunities. Global IPO activity increased substantially in 2024, with proceeds rising 17% YoY to $61.4B in the first half of 2025. The U.S. market has been particularly robust, with 150 IPOs raising $29.6B in 2024, representing a 39% increase in deal count and 33% increase in proceeds compared to 2023. The momentum has carried into 2025, with 153 companies going public year-to-date compared to 150 for all of 2024, proving that IPOs are starting to become a viable route for exits again. (13)

The quality of IPO candidates has improved significantly, with approximately 60% of 2025’s IPOs being profitable at the time of their debut, compared to just 20% during both the dot-com bubble and 2021’s SPAC-fueled period. This improvement reflects the extended private market timeline that has allowed companies to mature their business models and demonstrate sustainable profitability before going public. (5)

Case Studies in the 2025 Reopening

The most notable test came with Klarna’s September IPO, one of the largest fintech listings in recent memory. The Swedish payments giant raised over $5B and has so far held its valuation in aftermarket trading. For late-stage VCs, Klarna’s debut is a signal that scaled fintech and consumer companies can still find receptive public capital.

Other marquee deals are reinforcing this trend. CoreWeave, an AI infrastructure provider, has surged more than 300% since its March listing, while Circle Internet Group delivered a nearly 170% first-day return. These examples stand in contrast to the mixed record of 2021 and 2022, showing how extended private timelines allowed companies to mature before going public.

Together, these cases suggest investors are once again rewarding profitability and durable growth rather than chasing speculative multiples. The success of these listings will influence how quickly the backlog of late-stage companies makes its way to the public market.

Secondary Market Explosion

While IPO activity shows promise, the secondary market has emerged as the most immediate source of liquidity relief. Secondary market transaction volume reached a record $162B in 2024, representing a 45% increase from 2023’s $114B. The momentum has continued into 2025, with $102.23B in transactions in the first half alone, a 51% increase compared to the same period in 2024. (14)

LP-led transactions grew by 45% YoY to $87B in 2024, with 40% of sellers being first-time participants in the secondary market. This surge reflects LPs’ urgent need for liquidity since declining public market valuations make their private market allocations appear disproportionately large, limiting their ability to make new investments. (14)

GP-led deals, including continuation funds, reached a record $75B in 2024, up 44% YoY. Single-asset continuation vehicles have become particularly popular, accounting for 48% of GP-led volume as they allow sponsors to retain high-quality assets while providing some liquidity to LPs. (14)

The Road Ahead

After a prolonged drought, the U.S. private investment market is finally showing meaningful signs of relief. A reopened IPO window and record secondary activity are together easing the liquidity strain and beginning to restore capital recycling.

The backlog, however, remains historically large. Clearing it will require more than a few strong quarters, it will take sustained open markets, disciplined valuation expectations, and broader sector participation beyond AI and fintech. For LPs, the coming year will be a test of whether these green shoots translate into steady distributions and renewed fundraising momentum.

If current conditions hold, easing inflation, stable rates, and resilient investor demand, the next 12 to 24 months could reset the exit cycle. That would allow venture-backed startups and PE-owned businesses to return to a more predictable rhythm of investment and liquidity, unlocking the fresh capital flows that drive innovation and growth.

References

- https://www.cbh.com/insights/reports/private-equity-mid-year-trends-in-2025/

- https://www.deloitte.com/us/en/insights/industry/financial-services/private-equity-liquidity-challenges-and-fundraising-strategies.html

- https://alterdomus.com/insight/private-markets-mid-year-review-2025/

- https://www.pwc.com/us/en/services/consulting/deals/us-capital-markets-watch.html#:~:text=The%20time%20period%20from%20mid,of%20the%20IPOs%20exceeding%20100

- https://qz.com/ipo-market-recovery-2025

- https://carta.com/uk/en/data/ipo-activity-increase-q4-2024/

- https://www.ey.com/en_gl/newsroom/2025/07/h1-2025-global-ipo-activity-shows-resilience-amid-market-volatility

- https://www.schwab.com/learn/story/ipo-market-starts-to-warm-after-slow-start-to-2025

- https://www.collercapital.com/private-capital-findings-issue-21/pc-findings-21-the-numbers/

- https://www.sganalytics.com/blog/us-vs-backed-ma-deals-and-exits/

- https://www.junipersquare.com/blog/vc-q4-2024

- https://babn.org/event/13th-annual-funding-exits-and-ipos-2024/#:~:text=So%20far%20this%20year%20the,meaningful%20revival%20in%20early%202024

- https://www.renaissancecapital.com/IPO-Center/Stats#:~:text=Explore%20IPOs%20By%20Year,2024%20Initial%20Public%20Offerings

- https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf

- https://www.jdsupra.com/legalnews/is-an-ipo-window-opening-for-h2-2025-5922081/