What We’re Seeing

The Federal Reserve has initiated a new monetary easing cycle, signaling the end of the “higher-for-longer” rate regime. This pivotal shift is forcing a “Great Re-Allocation” of capital, as trillions of dollars held in high-yielding cash and money market funds are now seeking higher returns. Investors are moving this capital off the sidelines and into risk assets. This change is driven directly by the Fed’s decision to cut interest rates to support a cooling labor market, even with inflation remaining above its target.

Key Signals

Fed Easing

The Federal Open Market Committee (FOMC) cut the federal funds rate by 25 basis points to a 4.00%–4.25% range on September 17, 2025, the first reduction since December 2024.

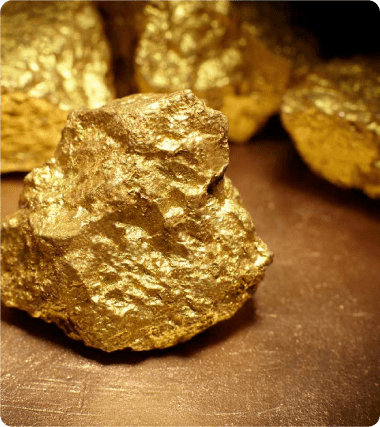

Gold Surges

Gold, a key beneficiary of lower real rates and a weaker dollar, surged to a new record high above $3,700 per ounce following the Fed’s announcement.

Risk-On Sentiment

Small-capitalization stocks, as measured by the Russell 2000 Index, were notable outperformers, signaling renewed investor appetite for rate-sensitive, cyclical assets.

Forward Guidance

The Fed’s median projection (“dot plot”) now anticipates a total of 75 basis points of rate cuts in 2025, implying two more cuts are likely this year.

Emerging Structural Trend

The rate cut is a critical catalyst poised to break the “liquidity logjam” that has constrained private markets for two years. During the high-rate period, difficult financing and volatile public markets made it nearly impossible for General Partners (GPs) to exit investments. This halted cash distributions to Limited Partners (LPs), who in turn lacked the liquidity to commit to new funds, stalling the entire capital flywheel. By lowering the cost of debt, the Fed’s action directly improves the economics for leveraged buyouts and sponsor-to-sponsor sales while fostering a more stable environment for IPOs. This reopening of the exit window will generate the distributions LPs need to re-commit capital, triggering a self-reinforcing recovery cycle. This dynamic will most benefit top-quartile GPs whose portfolios proved resilient during the downturn, likely widening the performance gap between the best and the rest.

Potential Investor Implications

Reduce Cash

Investors should strategically reduce overweight allocations to cash and money market funds, as their yields will steadily decline, creating a significant opportunity cost.

Extend Duration

Reallocate capital from cash into high-quality, intermediate-term bonds (e.g., 5-10 year maturities) to lock in attractive yields before they fall further.

Diversify Equities

Maintain an overweight to equities but increase diversification into international and emerging markets, which are poised to benefit from the tailwind of a weaker U.S. dollar.

Lean into Private Markets

For qualified investors, the improving outlook for dealmaking and exits makes this an opportune time to allocate to top-tier private equity and private credit funds to capture long-term growth and attractive income.

Sources

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20250917.htm

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250917.pdf

https://www.federalreserve.gov/monetarypolicy/files/monetary20250917a1.pdf

https://www.nuveen.com/global/insights/investment-outlook/fed-update?type=global

https://www.schwab.com/learn/story/fomc-meeting

https://www.fidelity.com/learning-center/trading-investing/the-fed-meeting